|

| by Jonathan Spader Senior Research Associate |

The tenure projections for growth in the number of homeowner and renter households through 2035 build directly on household growth projections also released by the Joint Center this week. We use these household growth estimates, along with data on homeownership rates from the Census Bureau’s Annual Social and Economic Supplement to the Current Population Survey (CPS/ASEC), to construct three scenarios that reflect a range of possible homeownership outcomes.

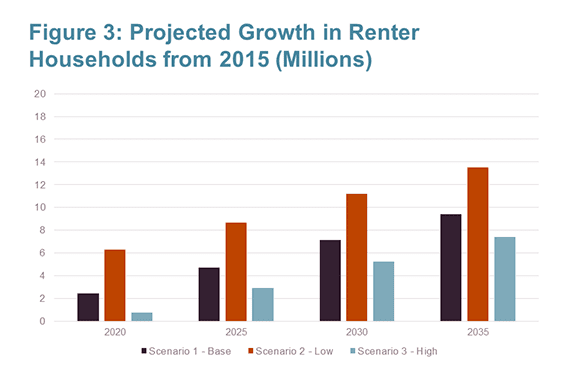

- Scenario 1 (“Base Scenario”) – Constant homeownership rates. The base scenario applies the 2015 homeownership rates by age, race/ethnicity, and family type to the projected household counts for each year. This scenario therefore describes the likely outcomes if homeownership rates stabilize near their current levels. By holding homeownership rates constant, this scenario also reveals the implications of changes in the distribution of U.S. households by age, race/ethnicity, and family type for the future homeownership rate.

- Scenario 2 (“Low Scenario”) – Continued decline through 2020 followed by constant homeownership rates. The starting point for the low scenario is the set of 2015 homeownership rates for each age, race/ethnicity, and family type category. The low scenario then projects the 2020 rates for each category by applying the 5-year cohort trends observed from 2010-2015. The 2020 homeownership rates for each age, race/ethnicity, and family type category are then held constant to project the homeownership rates for 2025, 2030, and 2035. This scenario describes the likely homeownership outcomes if the homeownership rate’s ongoing decline continues for several more years before stabilizing.

- Scenario 3 (“High Scenario”) – Homeownership rates return to pre-boom levels. The third scenario applies constant homeownership rates determined by the maximum of the 1995 and the 2015 rate for each age, race/ethnicity, and family type category. This scenario uses the 1995 homeownership rates to define the pre-boom levels that might reflect a longer-term equilibrium. It then adjusts the rates upward to the 2015 rates for older households and other groups for whom longer-term upward trends have kept the 2015 rates above their 1995 levels. The resulting homeownership rates therefore define a high scenario in which homeownership rates increase to levels slightly above than their 1995 levels, but well below their mid-2000s peaks. While such homeownership rate increases may be more plausible over longer-term periods than in the next few years, the high scenario applies these rates to all time periods, providing estimates of homeowner growth if the rates are realized within each time horizon.

|

| Source: JCHS tabulations of CPS ASEC data |

|

| Source: JCHS tabulations of CPS ASEC data |

|

| Source: JCHS tabulations of CPS ASEC data |

While the base scenario’s projections halt the decade-long decline in the homeownership rate, the projected homeownership rates remain below their levels between 1985 and 2015. This partial recovery reflects the possibility that slowing foreclosures and a strengthening economy will ease the downward pressure on the homeownership rate in coming years, while also allowing for the foreclosure crisis and Great Recession to carry some lasting impacts. The relative importance of these offsetting pressures will only be known with time, so the base scenario’s projections should be interpreted as a reference point for homeownership outcomes if the overall rate stabilizes around its 2015 level.

The low scenario describes the consequences of continued declines through 2020 before the homeownership rate stabilizes. Under this scenario, the projected homeownership rate falls from 63.5 percent in 2015 to 60.7 percent in 2020 before leveling off at 60.8 percent in 2025 and 60.6 percent in 2035. The homeowner growth figures show that the continuation of the 2010-2015 cohort trend implies minimal growth in the number of homeowner households, adding just 755,471 additional homeowner households through 2020. In subsequent years, the eventual stabilization of the homeownership rate at 2020 levels allows household growth to add 4.9 million homeowner households through 2025 and 11.6 million homeowner households through 2035. This sluggish growth in homeowner households is accompanied by faster increases in the number of renter households, with 8.7 million additional renter households by 2025 and 13.5 million additional renter households by 2035.

The projected declines in the homeownership rate through 2020 reflects the replication of recent cohort trends from the starting point of cohorts’ already-low 2015 homeownership rates. The projected 2020 rates therefore assume a continuation of the foreclosure-related homeownership exits, tight credit conditions, weak incomes, and other factors that contributed to the homeownership rate’s recent declines. Additionally, they assume the absence of any catch-up growth due to pent up demand among households unable to buy a home in recent years or to homeownership reentries among households that experienced a foreclosure. The low scenario therefore defines a trajectory that reflects the continuation of recent declines for several more years before the homeownership rate stabilizes.

In contrast, the high scenario projections describe homeownership outcomes under assumptions that project a reversal of recent declines and returns homeownership rates to levels slightly above the pre-boom period. The projected homeownership rates for the high scenario increase from 63.5 percent in 2015 to 64.9 percent in 2020, before leveling off at 65.0 percent in 2025 and 64.7 percent in 2035. This higher homeownership rate trajectory implies the addition of 10.6 million homeowner households and 2.9 million renter households by 2025, and 17.7 million homeowner households and 7.4 million renter households by 2035.

The higher homeownership rates produced by this scenario reflect the combination of 1995 homeownership rates with an adjustment for longer-term upward trends in the homeownership attainment of certain groups, particularly older households. While there is no clear “normal” equilibrium for the homeownership rate, this scenario adopts the 1995 rates as the most recent year that precedes the housing boom and bust. Additionally, it assumes that any groups with higher levels of homeownership attainment in 2015 compared to 1995 will sustain the higher 2015 levels into the future. This assumption implies an uptick in cohort trends that fully catches up to the level defined by the maximum of the 1995 or 2015 rate. This result may be particularly tenuous for middle-aged households, who experienced the most severe effects of foreclosures and may not reach the homeownership rates of prior cohorts. To the extent that the foreclosure crisis and Great Recession have had significant impacts for some cohorts, this scenario therefore assumes that such effects will be offset by broader changes in the economy, credit conditions, or housing markets over time.

Read the working papers:

Waiting for Homeownership: Assessing the Future of Homeownership, 2015-2035

Homeowner Households and the U.S. Homeownership Rate: Tenure Projections for 2015-2035

Updated Household Projections, 2015-2035: Methodology and Results

No comments:

Post a Comment